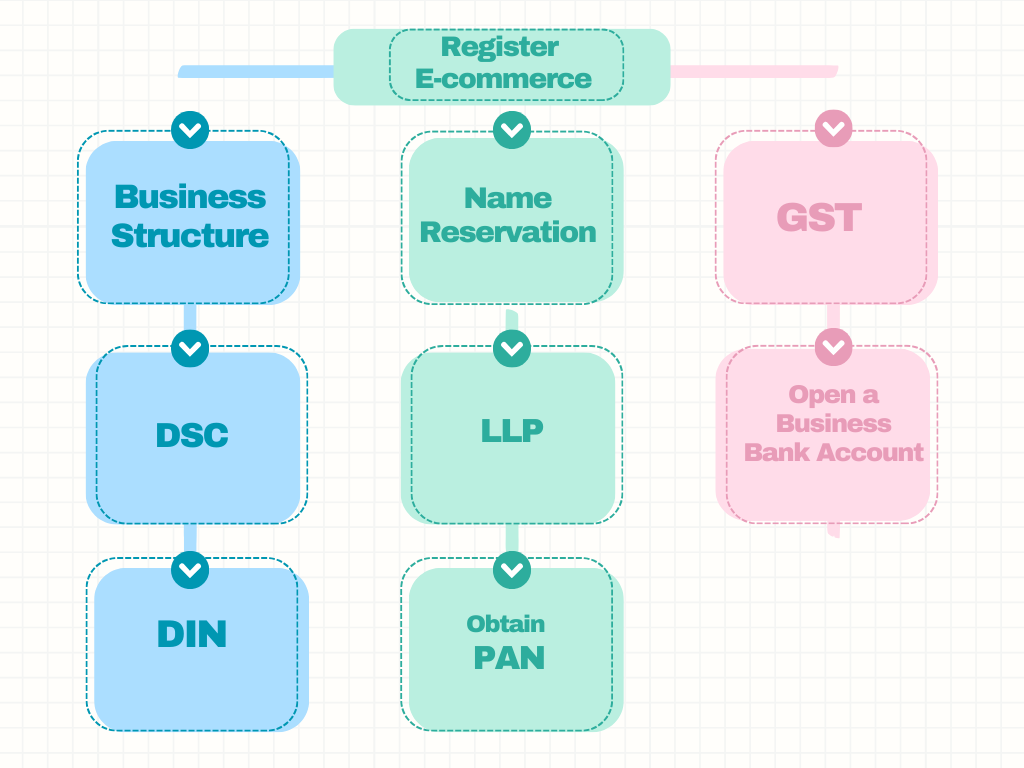

How to Register an E-commerce Business in India?

3 October 2023

Contents

Beginning your online business in India is an exciting adventure, but it starts with handling the legal side of things. This guide will take you through each step to register your e-commerce business, making your entrepreneurial journey a success.

1. Choose a Business Structure:

To start your online business in India, you need to pick the right way to set it up. You can choose from different options like being the only owner, partnering with others, or creating a private company. In India, options include Sole Proprietorship, Partnership, Limited Liability Partnership (LLP), Private Limited Company, and One Person Company (OPC). Think discover_our_mission what kind of business you have and what you want to achieve before making this decision.

2. Obtain a Digital Signature Certificate (DSC):

In this online world, having digital proof is very important. Make sure you get a Digital Signature Certificate (DSC) to file the documents with the Ministry of Corporate Affairs (MCA). This ensures your business papers are secure and genuine.

3.Get a Director Identification Number (DIN):

If you're choosing a private limited company or an LLP, people who want to be directors or partners need to get a Director Identification Number (DIN). This special code is a must before taking on a directorial role.

4. Name Reservation:

Picking a unique name for your online business is crucial. Check if the name is available, and if it is, save it with the Registrar of Companies (ROC) using the MCA portal. Make sure your business name matches what you want your brand to be.

5. Incorporate the Company or LLP:

Now that you've got the name, move on to officially creating your business. Fill out important papers like the Memorandum of Association (MOA) and Articles of Association (AOA) if it's a company or the LLP agreement if it's an LLP. Doing this makes your business official and sets up the legal rules for how it works.

6. Obtain a Permanent Account Number (PAN):

Get a Permanent Account Number (PAN) for your online business. PAN is essential for money stuff and following the rules. Make sure all the info you provide during the PAN application is correct and current.

7. Goods and Services Tax (GST) Registration:

If you're running an online business, you need to sign up for Goods and Services Tax (GST). It's a must if your business makes more than a certain amount each year. Registering for GST helps you follow the tax rules without any issues.

8. Open a Business Bank Account:

After you finish all the legal stuff, open a special bank account just for your online business. Keeping your personal and business money separate is essential so everything is clear and organized for accounting.

conclusion

Getting your e-commerce business registered in India is a step-by-step process, and each part is super important for making sure your business is legal and does well. By carefully going through things like picking the right business setup, getting the right certifications, and following tax rules, you're building a strong base for your e-commerce adventure. Every step is like a building block for your business, making sure it's legal, trustworthy, and ready for the long run in the lively Indian market.